top of page

The Nowcasting Blog

AKAnomics 25Q3 Nowcasting Performance

In 25Q3 AKAnomics highlighted 45 companies with significant disconnect from consensus, out of the 140 US Industrials/Materials/Consumer Discretionary names it tracks. With 25Q3 earnings season wrapping up with a majority of those 140 companies having announced their results, AKAnomics estimates were on the right side of consensus for 33 of the 45 names (73% hit rate). The higher the hit rate, the stronger is the forward returns characteristics (see blog ) , and positioning s

Nov 20, 20251 min read

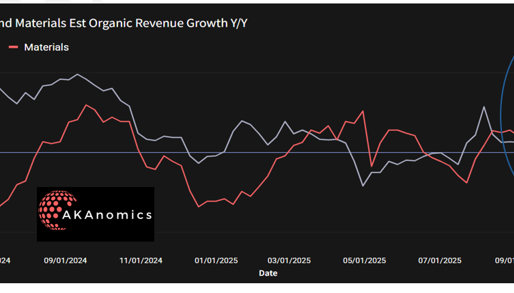

Revenue Nowcasting: Industrials Revenue Growth Holding in Q3

AKAnomics delivers Revenue Nowcasting estimates for US Industrials and Materials names to fundamental and quantitative hedge funds. A question persistent on investors’ minds is whether the economy is showing signs of strain from tariffs, inflation, and demand. Based on our real-time analysis of 6000+ macro data from around the world, AKAnomics data indicates that 25Q3 organic revenue growth for this group is holding up well, slightly better than 25Q2 driven by improving gro

Oct 24, 20251 min read

Revenue Nowcasting: Improving Sharpe through Mean Reversion

AKAnomics delivers Revenue Nowcasting estimates to both fundamental and quantitative hedge funds. A natural question asked by “quant” funds is if AKAnomics signals can be defensibly combined with other quant signals to further improve risk-adjusted returns. We believe that Mean-Reversion is one such signal. It makes sense to us that if a company’s price has recently gone up significantly (from its historical average), then a positive expectation for revenue surprise is unlike

Oct 15, 20252 min read

The Value of Revenue Nowcasting in Systematic Strategies

AKAnomics focuses on Nowcasting current quarter revenues of companies, especially in cyclical industries like US Industrials and...

Oct 10, 20251 min read

The Nowcasting Edge: Monthly AKAsights into Industrials / Focus on 25Q3

The focus of the 5 th Monthly AKAnomics Webinar was Q3 revenues – what the world’s economic data is suggesting, and how AKAnomics...

Sep 23, 20253 min read

Webinar summary for The Nowcasting Edge: Monthly AKAsights into Industrials / Focus on Q3 (08/25/2025)

Q2 Recap Q2 Industrials organic revenue growth came in flat as outlined by AKAnomics in its last webinar. AKAnomics had highlighted 25...

Aug 27, 20251 min read

25Q2 Industrials Nowcasting Performance

In 25Q2 AKAnomics highlighted 25 companies with significant disconnect from consensus, out of the 140 US Industrials/Materials/Consumer...

Aug 7, 20251 min read

Can economic data help systematically pick stocks?

The proof is in the pudding! AKAnomics uses macro-economic data to decipher which US Industrials, Materials, and Consumer Discretionary...

Jul 30, 20251 min read

bottom of page

.png)